The Basic Principles Of Paul B Insurance Insurance Agent For Medicare Huntington

Not known Factual Statements About Paul B Insurance Medicare Insurance Program Huntington

Table of ContentsAll About Paul B Insurance Medicare Health Advantage HuntingtonPaul B Insurance Local Medicare Agent Huntington Fundamentals ExplainedThe 25-Second Trick For Paul B Insurance Medicare Advantage Plans HuntingtonThe 7-Second Trick For Paul B Insurance Medicare Advantage Plans HuntingtonThe Greatest Guide To Paul B Insurance Medicare Insurance Program HuntingtonEverything about Paul B Insurance Medicare Advantage Plans Huntington

As an example, for some actions, in 2022, if the ranking on that particular measure was reduced than the prior year, the ratings changed back to the 2021 worth to hold plans harmless. An extra 2 percent of enrollees remain in plans that were not rated since they are in a plan that is too new or has too low registration to receive a ranking.The star ratings showed in the number over are what beneficiaries saw when they selected a Medicare plan for 2023 and are different than what is utilized to establish bonus payments. In the last few years, Medication, special-interest group has raised problems concerning the celebrity score system and quality perk program, including that star scores are reported at the agreement as opposed to the strategy level, and also might not be a helpful indication of top quality for beneficiaries due to the fact that they include way too many steps.

Select a Medicare Supplement plan (Medigap) to cover copayments, coinsurance, deductibles, and other expenditures not covered by Medicare.

The Paul B Insurance Medicare Part D Huntington Ideas

An HMO might require you to live or operate in its solution location to be eligible for protection. HMOs frequently provide incorporated care as well as emphasis on avoidance and wellness. A kind of plan where you pay less if you make use of doctors, health centers, and various other healthcare providers that come from the strategy's network.

A kind of health and wellness strategy where you pay much less if you make use of suppliers in the strategy's network. You can make use of doctors, hospitals, and service providers outside of the network without a reference for an additional expense.

Having a common resource of care has been discovered to enhance high quality and also reduce unnecessary care. The majority of individuals age 65 and older reported having a typical carrier or place where they receive care, with slightly greater rates amongst people in Medicare Advantage prepares, people with diabetes mellitus, as well as people with high requirements (see Appendix).

Paul B Insurance Medicare Advantage Agent Huntington Fundamentals Explained

There were not statistically substantial distinctions in the share of older adults in Medicare Advantage prepares reporting that they would constantly or often receive a solution about a clinical problem the exact same day they called their usual resource of care contrasted to those in typical Medicare (see Appendix). A larger share of older adults in Medicare Benefit strategies had a wellness care professional they might conveniently get in touch with in between doctor sees for suggestions concerning their wellness problem (information disappointed).

Evaluations by the Medicare Repayment Advisory Commission (Med, PAC) have actually revealed that, usually, these plans have lower clinical loss ratios (suggesting greater earnings) than other kinds of Medicare Advantage strategies. This shows that insurance companies' rate of interest in serving these populaces will likely remain to expand. The findings additionally elevates the essential to examine these plans separately from various other Medicare Benefit plans in order to make sure premium, equitable care.

In certain, Medicare Advantage enrollees are most likely than those in standard Medicare to have a treatment plan, to have someone who examines their prescriptions, and also to have a routine physician or location of treatment. By giving this additional assistance, Medicare Benefit strategies are making it much easier for enrollees to obtain the help they require to manage their health and wellness care problems.

The Main Principles Of Paul B Insurance Medicare Health Advantage Huntington

The survey results additionally elevate inquiries about whether Medicare Benefit strategies are getting ideal payments. Medication, special-interest group approximates that strategies are paid 4 percent more than it would cost to cover comparable individuals in traditional Medicare. On the one hand, Medicare Advantage prepares appear to be offering services that assist their enrollees manage their care, as well as this added care management could be of significant worth to both strategy enrollees and the Medicare program.

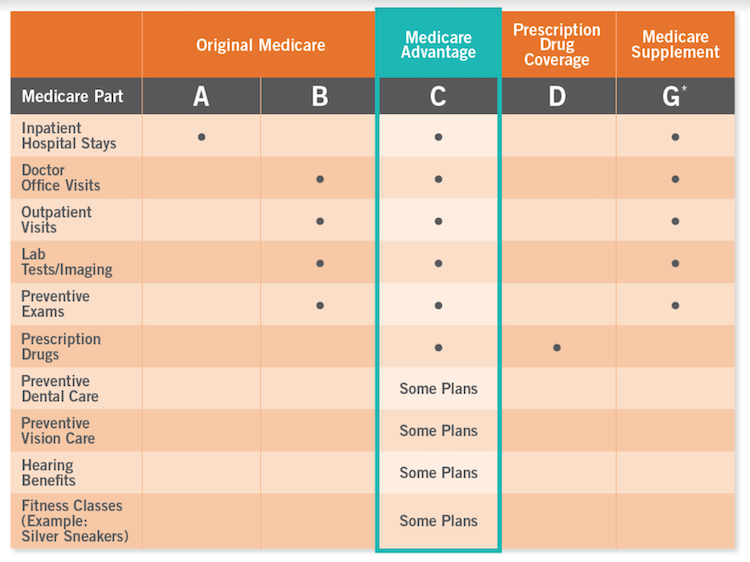

Part B complements your Component A coverage to offer protection both in and out of the hospital. Part An and Component B were the very first parts of Medicare developed by the government. This is why the two parts with each other are usually referred to as "Original Medicare." In addition, the majority of people that do not have extra coverage via a group strategy (such as those supplied by employers) generally register for Parts An as well as read what he said B at the see this page very same time.

The Best Strategy To Use For Paul B Insurance Medicare Advantage Plans Huntington

The quantity of the premium varies among Medicare Benefit strategies. Medicare Benefit puts a limitation on the quantity you pay for your protected clinical treatment in a provided year.

Some Medicare Advantage intends need you to use their network of service providers. As you discover your options, think about whether you desire to continue seeing your existing medical professionals when you make the switch to Medicare.

Paul B Insurance Medicare Supplement Agent Huntington Can Be Fun For Everyone

What Medicare Supplement plans cover: Medicare Supplement prepares assistance handle some out-of-pocket costs that Original Medicare doesn't cover, consisting of copayments and also deductibles. That means Medicare Supplement strategies are just readily available to individuals that are covered by Initial Medicare. If you choose a Medicare Advantage plan, you're not qualified to get a Medicare Supplement plan.